Lifetime allowance

It has been frozen at 1073m since the 202021 tax year and has. Chancellor scraps lifetime allowance Chancellor Jeremy Hunt has scrapped the lifetime allowance on pension pots Reuters By Amy Austin In a shock announcement chancellor Jeremy.

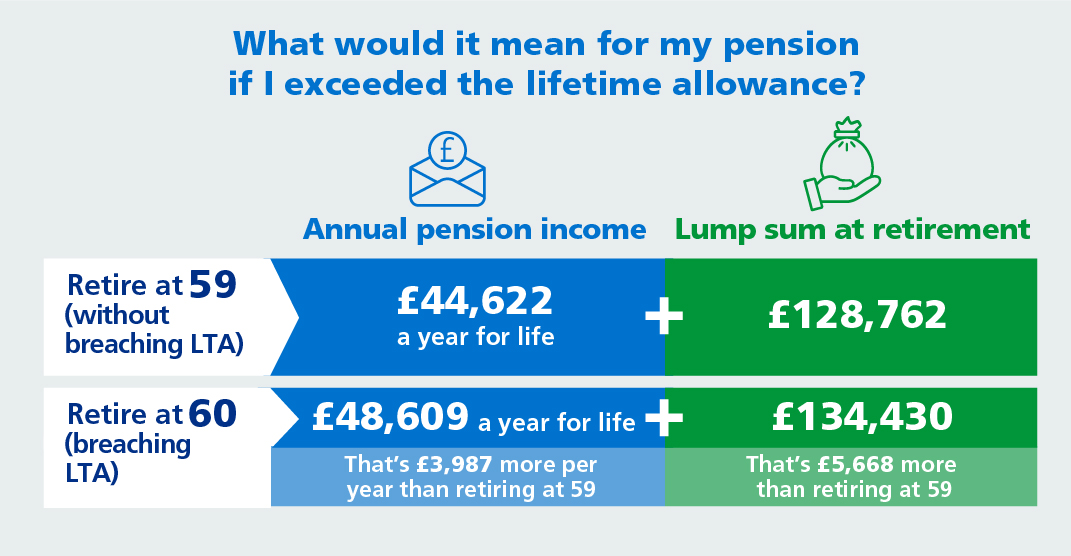

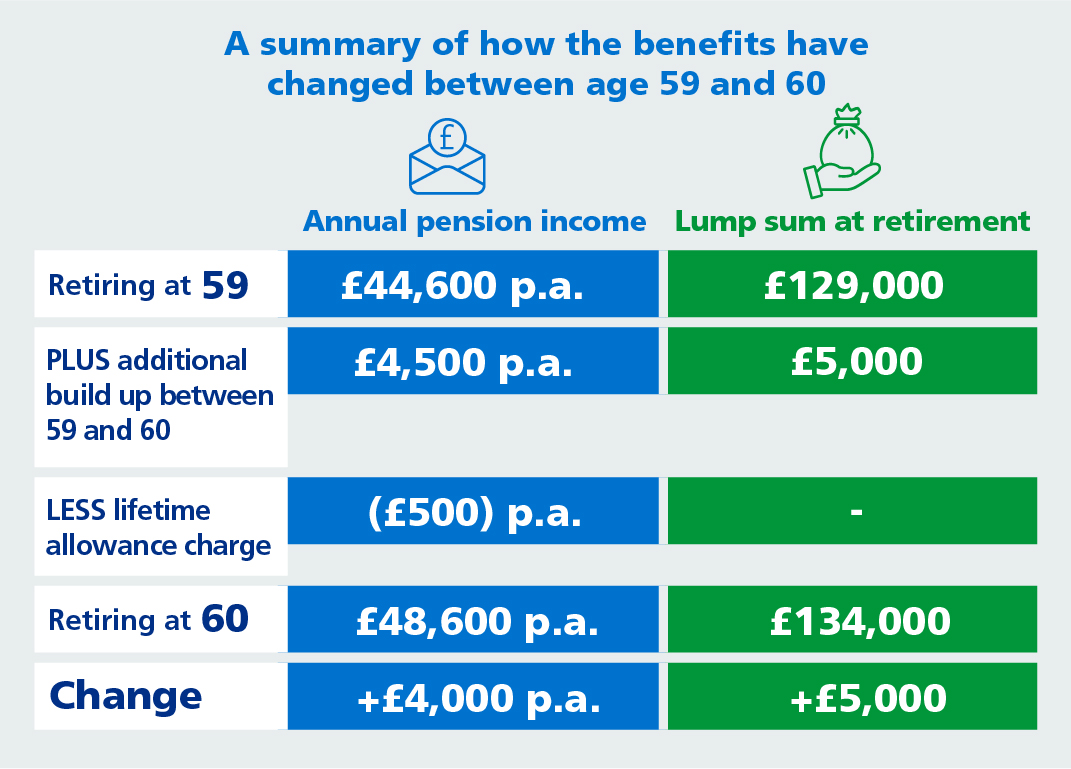

Could It Pay To Breach The Pensions Lifetime Allowance Shares Magazine

This means that you can give up to 1292 million in gifts over the course of your lifetime without ever having to pay gift tax on it.

. Web 1 day agoChancellor Jeremy Hunt used his budget on Wednesday to announce the abolition of the lifetime pensions allowance. Web For 2023 the lifetime gift tax exemption as 1292 million. From 201819 the lifetime allowance increased every year by inflation as measured by the Consumer Prices Index rate the previous September.

Web This measure applies to all members of registered pension schemes. You might be able to protect your pension pot from. The chart below shows the history of the lifetime allowances.

Mr Hunt will outline his Spring Budget to Parliament on. It means people will be allowed to put aside as much as they can in their private scheme without being taxed - removing the 107m limit. In September 2019 inflation stood at 17.

Web Lifetime allowance You usually pay tax if your pension pots are worth more than the lifetime allowance. For married couples both spouses get the 1292 million exemption. This is currently 1073100.

Web 1 day agoThe lifetime allowance itself is set to be abolished from April 2024 in the meantime the lifetime allowance charge will be removed from 6 April 2023 meaning no-one will incur the charge. Web In 2022-23 the lifetime allowance remained at 1073m and it is now frozen until 2026. Web Currently the so-called lifetime allowance - the amount you can accumulate in your pension pot before extra tax charges - is 107m.

Web 1 day agoBudget 2023. From 6 April 2023 it removes the Lifetime Allowance LTA charge and limits the pension commencement lump sum PCLS to its. Web 2 days agoThe lifetime allowance is the amount that someone can save in total for their private pension without incurring a tax charge.

Web The lifetime allowance is the maximum amount of pension savings an individual can build up without a charge being applied when they take their benefits. Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being subject to the lifetime allowance charge.

Jyifsf935h0sym

Will The Pension Lifetime Allowance Increase In The Uk What To Expect Bm

Pension Lifetime Allowance Explained Nerdwallet Uk

Lifetime Allowance Charge Are There Strategies For Mitigation Novia Iq

Nhs England Understanding The Lifetime Allowance

Blue Heron Financial Services Ltd Pension Lifetime Allowance How It Affects You

Pensions Lifetime Allowance Devaluation Continues Jackson Toms

What Is The Pension Lifetime Allowance Nuts About Money

How To Cope With The Lifetime Allowance Aj Bell Investcentre

Nhs England Understanding The Lifetime Allowance

5oje2ctnqs Fwm

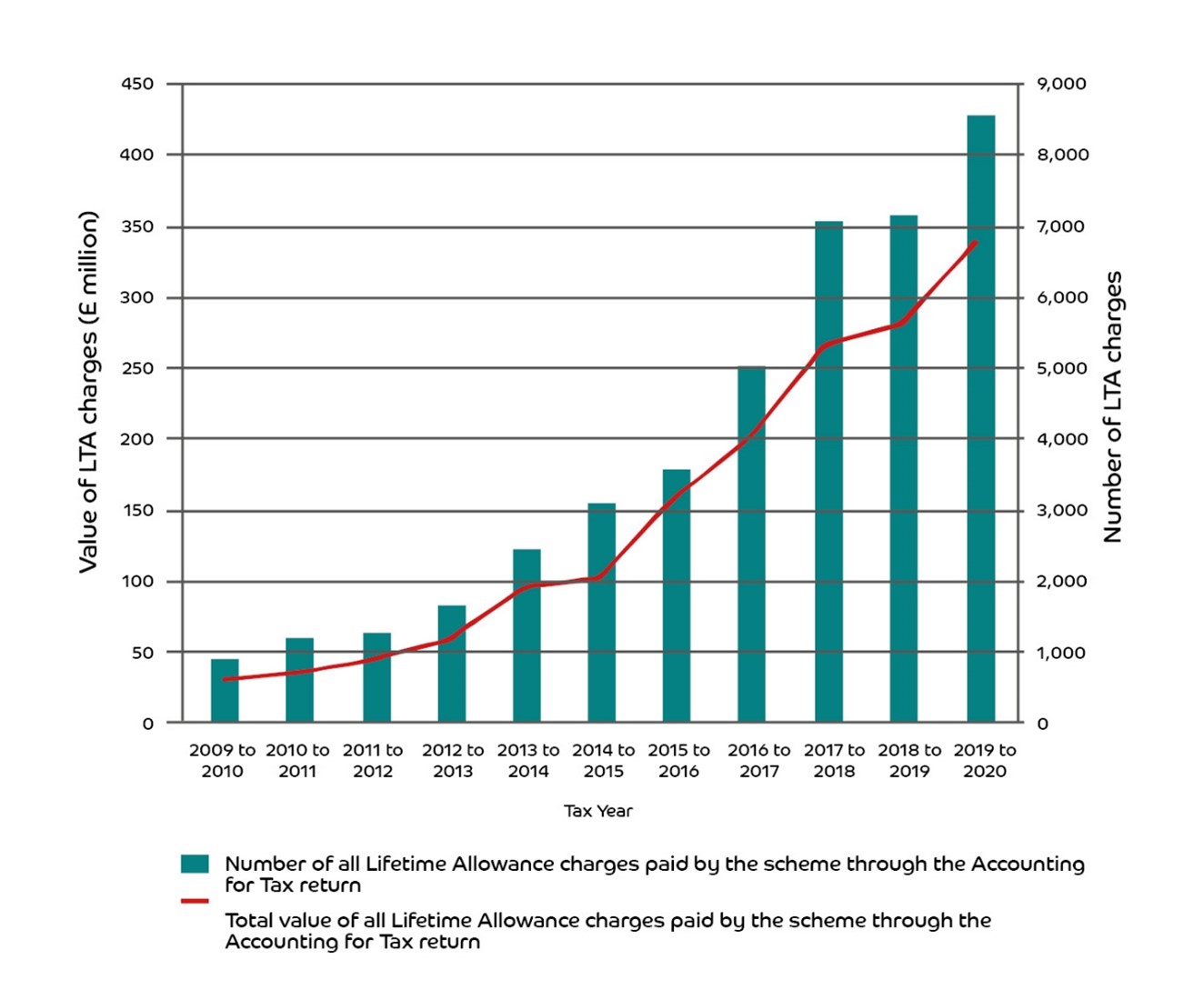

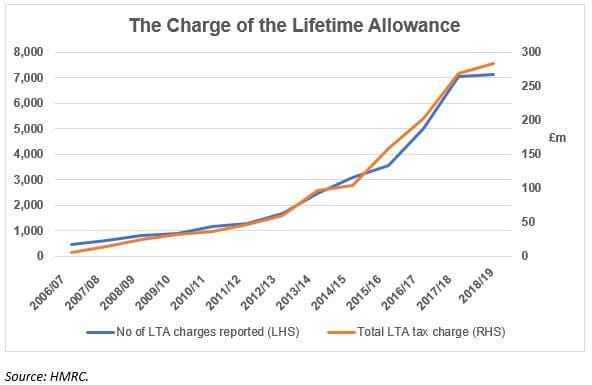

Pension Lifetime Allowance Tax Take Jumps By Over 1 000

Pension Lifetime Allowance Cuts On The Horizon Chase De Vere

Xjfvamqpnxrdhm

Pensions And Tax The Lifetime Allowance Today S Wills And Probate

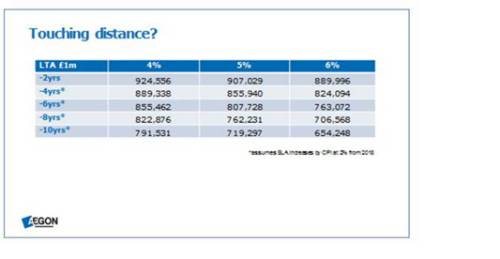

Aegon Highlights Hidden Risks Of Breaking Lifetime Allowance

What Is Pension Lifetime Allowance Lta And What Happens If You Exceed Your Allowance